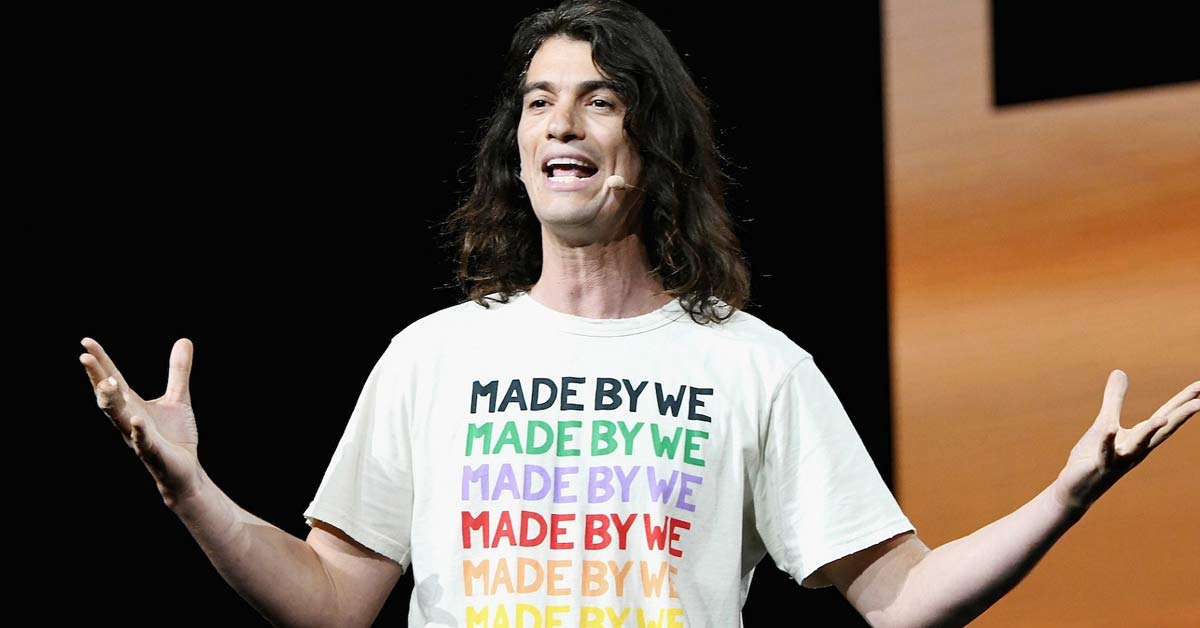

Former WeWork CEO Adam Neumann‘s climate tech startup, Flowcarbon, has reportedly begun refunding investors. The company had set out to revolutionize the carbon credit market by leveraging blockchain technology but ultimately failed to deliver on its ambitious promises. As a result, Flowcarbon is now returning funds to its investors, marking a disappointing turn for Neumann’s venture into the climate tech space.

Investors who purchased Flowcarbon’s “Goddess Nature Token” have been offered refunds over the past month, but with conditions. According to Forbes, buyers must sign a confidentiality agreement and relinquish any potential claims against Flowcarbon and its affiliates to receive reimbursement. Notably, Flowcarbon secured $32 million in funding from prominent backers like Andreessen Horowitz, Samsung Next, and Invesco in 2022. Additionally, token sales generated at least $38 million.

The Goddess Nature Tokens were envisioned as equivalent to carbon credits, certificates that companies purchase in bulk to offset their greenhouse gas emissions. These credits represent a significant environmental impact, with each one corresponding to one metric ton of carbon dioxide either removed or prevented from entering the atmosphere. This lucrative market has proven highly profitable for companies like Tesla (TSLA -0.29%), which has generated billions of dollars in revenue by selling carbon credits to major firms, including Shell, Chevron, and others, highlighting the substantial demand for these environmental offsets.

Flowcarbon’s Carbon Smart Summit is scheduled to take place later this month, featuring a prestigious lineup of speakers. The event will bring together the startup’s key executives, including its Chief Business Officer and Head of Carbon Banking and Markets, as well as co-CEOs Dana Gibber and Caroline Klatt. Joining them will be esteemed guest speakers, including Congressman Ritchie Torres and several prominent business and technology leaders, for insightful discussions on the future of carbon management.

To avoid confusion, note that Flowcarbon is a separate entity from Flow, another venture-backed by Andreessen Horowitz (a16z). Flow, a residential real estate company valued at $1 billion, is currently developing a mixed-use project in Miami, Florida, as part of its portfolio.