UAE’s PayBy has reportedly partnered with LuLu Group, a Middle East’s conglomerate. After a successful pilot in Abu Dhabi, PayBy has launched several contactless payment solutions across over 60 hypermarkets and stores in the UAE.

To prevent the spread of coronavirus through currency or cards, the UAE Central Bank in March urged the use of contactless payment methods. In response to growing consumer demand, PayBy’s QR Code-based contactless solutions are supporting UAE retail businesses as they transition to recovery in the wake of COVID-19.

When shopping in LuLu stores and hypermarkets, customers simply present the QR code in the PayBy app, let the cashier scan it, and wait for the payment confirmation. After entering their PIN, TouchID, or Face ID on their device, they can check the payment confirmation – the quick, contactless transaction is thus completed.

Commenting on the development, V. Nandakumar, Director, Marketing and Communications, LuLu Group, in a statement quoted,

“The LuLu Group is entering an ambitious phase of accelerated digital transformation and will rely on partnerships with innovative payment solutions such as PayBy that can be easily and swiftly integrated with existing payment infrastructure. Moving away from cash-based transactions offers greater safety, convenience, and efficiency for consumers and businesses, and supports the UAE government as it strives towards increased financial inclusion in the economy.”

Founded in 2011 by Camilo Acosta, Dan Oblinger, and Frank Langston, PayBy supports retailers looking to grow revenue through contactless payments without capital-intensive infrastructure upgrades. Their point of sale (PoS) solutions can be adopted by a range of businesses – hypermarkets, taxis, baqala stores, restaurants, beauty salons, and malls. The PoS solutions can be installed without any setup or monthly fees, and with lower transaction fees than existing solutions.

Financial transactions on PayBy are well protected by leading and proven technologies. The QR code generated by PayBy is based on tokenization – widely acknowledged as a more secure payment method as it is processed without exposing sensitive payment information.

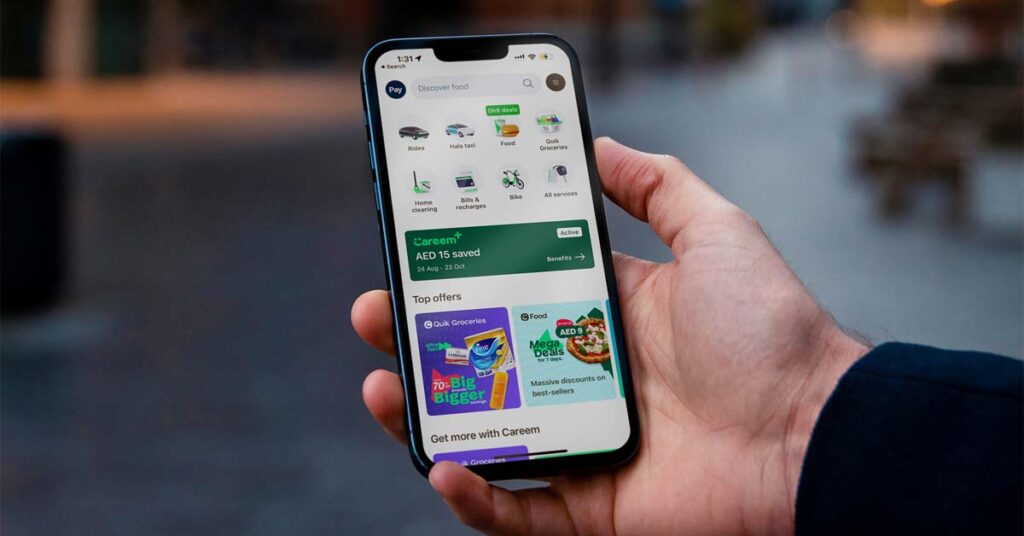

PayBy is integrated into popular instant messaging platforms such as BOTIM and ToTok. It can be used for payments at different merchants, to pay for deliveries on arrival, order goods and services online, transfer and receive money instantly, and even share cash gifts with family and friends.

ⓘ LAFFAZ is not responsible for the content of external sites. Users are required to read and abide by our Terms & Conditions.