India has one of the largest and fastest-growing economies globally and is the second-largest country by population. Therefore, India attracts enormous interest from investors from countries, such as the USA, UAE, and China. Indian Private Equity and Venture Capital market is huge and growing fast, fueled by a growing economy and expansion in deal size. With a rapidly growing number of private companies and startups in India, PE, VC, and Angel investors are an important source of capital.

While fundraising in certain regions, it’s essential to know the specifics of the Indian region. Today we’ll take a look at the specifics of Indian PE/VC investors and the options this country can give to those who’re looking for funding there.

Which specific features do Indian investors have?

- Deep industry expertise: Technology, healthcare, and finance are among the sectors in which Indian investors have deep industry expertise. That means complex products and concepts can be presented here and meet investors’ understanding. Apart from it, you can get insights into how to improve your product to be successful in the industry.

- Relationships then risk: Indian investors prefer building a personal relationship before moving to a business part. Prepare to provide a lot of detailed info about yourself and your company so the investors could reduce the risks.

- Early-stage startups are welcomed: However, Indians are open to taking risks by investing in young startups. Especially, if it’s cutting-edge technologies such as blockchain, artificial intelligence, and biotech – where a significant amount of capital was already invested.

- Time flexibility: Indians can be flexible about time frames and not give advance notice of any issues that may arise so you need to keep in mind that a couple of follow-ups would be great to get answers in time.

- Indirect communication: While follow-upping don’t forget to be respectful and so open as it usually can be in countries with a more direct communication style. Be polite and careful since a direct communication style may seem rude.

Top PE/VC funds of the region

All of the funds on this list below have delivered strong returns over the past 5 years, outperforming their respective benchmarks and peers.

- Sequoia Capital India

- Accel India

- SAIF Partners

- Matrix Partners India

- Blume Ventures

- Nexus Venture Partners

- Lightspeed India Partners

- Kalaari Capital

- Inventus Capital India

- Helion Venture Partners

- Orios Venture Partners

- 3one4 Capital

- Chiratae Ventures (formerly IDG Ventures)

- Aavishkaar Venture Management Services

- Stellaris Venture Partners

- IvyCap Ventures

- Infuse Ventures

- Beenext

- 8i Ventures

- Ankur Capital

- Prime Venture Partners

- Unitus Ventures

- India Quotient

- pi Ventures

- WaterBridge Ventures

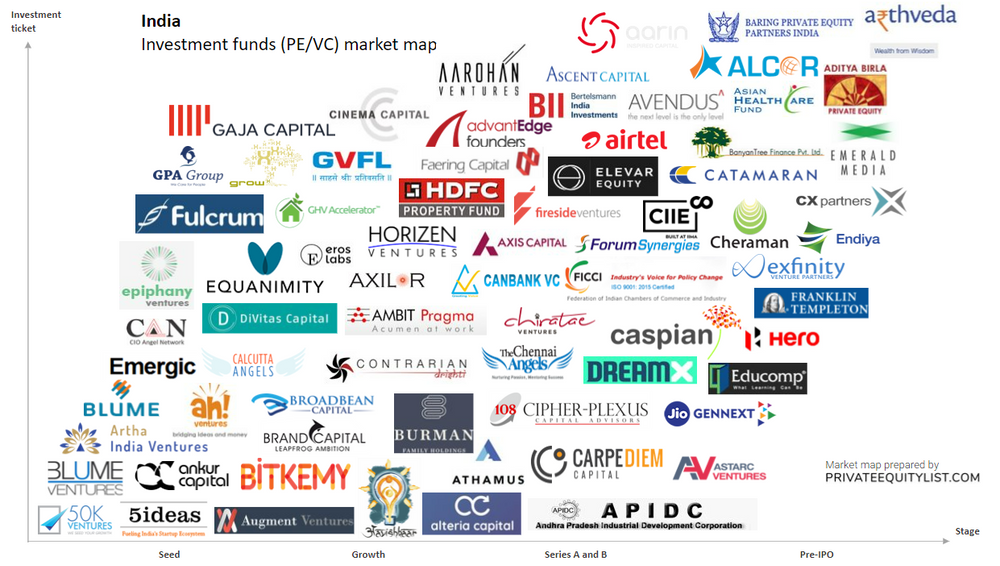

Market map of Indian funds

Overall there are over 225+ PE/VC funds in India and their number is growing.

With plenty of local Indian PE and VC firms, there are many top-tier global companies among the most active investors, such as Blackstone Group, KKR, and Sequoia Capital. Despite the emergence of local investors, global PE and VC firms still constitute a significant share of investments in India. There are both generalist and specialist investors, focusing on particular sectors. Among the popular sectors are Financial Services, Information Technology and Business Processes Outsourcing (IT & BPO), Consumer Goods and Retail, Telecommunications, Internet, Pharma and Healthcare, Energy, Infrastructure, and Real Estate. Indian PE/VC/Angels invest in companies and startups at all stages, from seed and Rounds A and B to growth capital, private investment in public equity (PIPE), and buyouts. Most Private Equity and Venture Capital firms are concentrated in Mumbai, Indian financial and commercial capital, or New Delhi.

Part-1

Part 2

Part 3

You can find more info about these funds and their contacts at https://privateequitylist.com/search