Mumbai-based online beauty platform Purplle on Thursday secured $30 million in a Series C round led by global investment banking major Goldman Sachs along with existing backers including IvyCap Ventures, Blume Ventures and JSW Ventures.

The company will utilise the funding to expand and strengthen its supply chain, marketing and technology. Since its launch in 2012, this is the biggest round for the company.

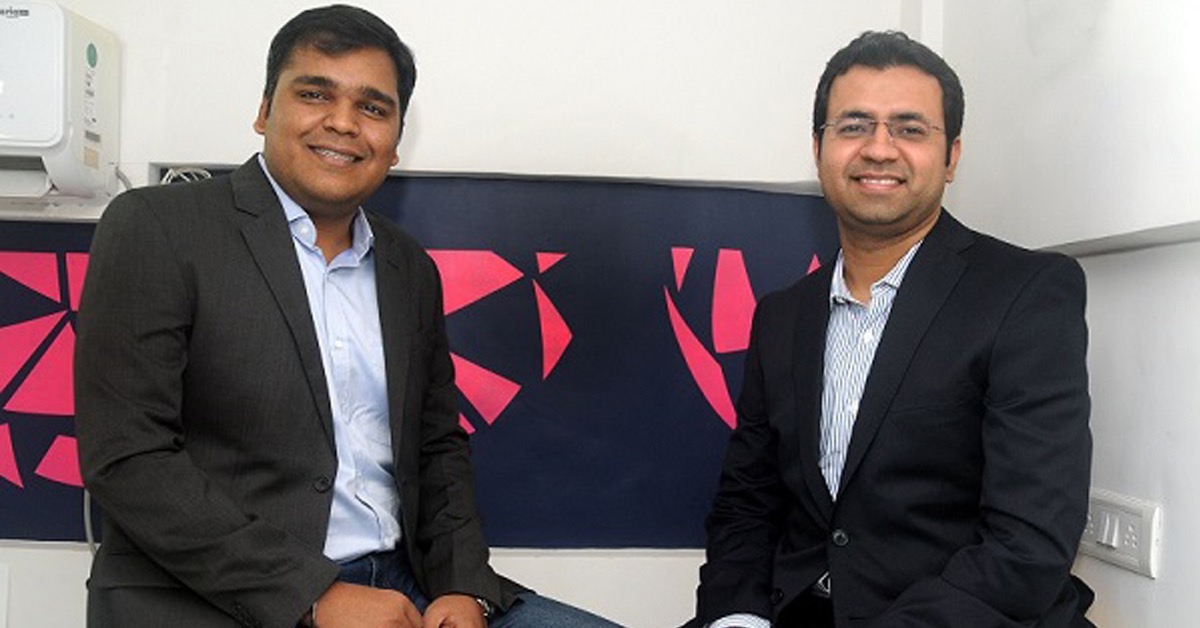

Purplle.com’s co-founder & CEO, Manish Taneja, in a statement said “This investment from Goldman Sachs is a testament to the promise and potential of Purplle. This new funding will help propel the business to its next phase of growth for our customers and investors.”

Niladri Mukhopadhyay, a Managing Director at Goldman Sachs, said “Purplle, which has managed impressive growth while applying financial discipline, is one of the most promising vertical e-commerce platforms in India. We look forward to leveraging our global experience and network for the continued growth of Purplle.”

It is estimated that the $7 billion Indian online beauty and personal care market is growing at over 15 per cent compounded annual growth rate (CAGR), driven by increasing awareness of the category and penetration in tier-2 and tier-3 cities.

It has been more than 3 years since the company scooped its last funding, which was $6 million in Series B round from JSW in July 2016.

As reported by Entrackr, Purplle claims to have over 47,000 stock keeping units (SKUs) across more than 1,000 third-party, including in-house brands. Over the past two years, Purplle’s net merchandise value has quadrupled, claims the company in a press statement.

According to the annual financial report, the company is very close to turning profitable. While its revenue recorded 3X growth in FY19 to Rs 101.48 crore from Rs 31.35 crore in FY18, during the period, it managed to control its losses by over 70% to Rs 4.07 crore.