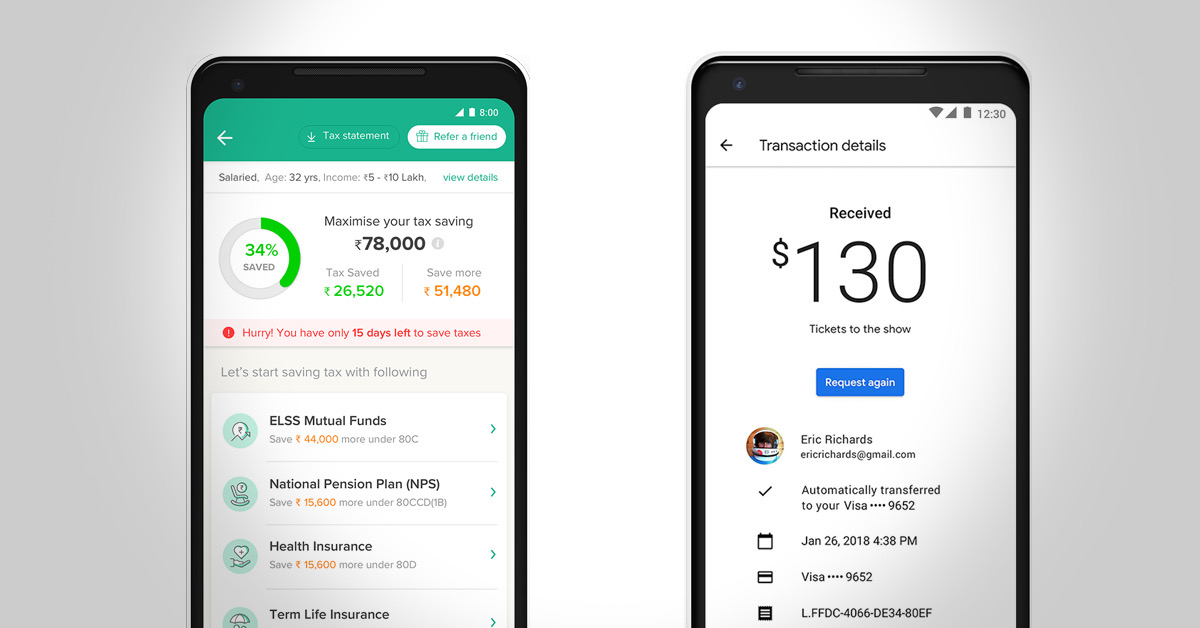

- The partnership will allow Google Pay users to invest in Mutual Funds and NPS from the app

- First-time investors can complete their KYC within minutes without any paperwork

ETMONEY that offers instant mutual fund investments, loans and insurances through its mobile app, on Thursday announced that it has entered into a strategic partnership with Google Pay. The partnership will enable Google Pay’s users to invest in mutual funds and NPS through Google Pay app itself.

This collaboration will allow Google Pay users to identify the right Mutual Funds and invest in them within minutes using their Google account and UPI ID. Google Pay users won’t need to create any user ID or worry about remembering multiple passwords. They will also experience the same ease while investing in the world’s cheapest retirement product, the National Pension System.

To make sure millions of Google Pay users who are staying away from investing due to hassles involved in completing KYC can start their journey to wealth creation, ETMONEY has enabled zero paperwork, instant KYC on the Google Pay App. Users can also go through curated lists of investment themes, see top mutual funds, and do a comparative analysis to make investment decisions quickly and with confidence.

Speaking on the partnership, Mukesh Kalra, Founder-CEO of ETMONEY, said,

“Innovation has been the cornerstone of our growth. ETMONEY’s integration with Google Pay is yet another innovation that marries the convenience of ETMONEY with the expansive reach of Google Pay. This will be a big push for the country’s financial ecosystem. We are starting with Direct Mutual Funds and NPS and will soon expand to our other offerings in the near future. The sheer reach and native experience offered by both platforms will be extremely helpful in driving the mission of simplifying the financial journey of millions of Indians.”