President Donald Trump’s decision to allow Nvidia to sell its advanced H200 artificial intelligence chips to China has triggered a rare bipartisan backlash in Washington, reopening debates over U.S. export controls, national security, and America’s long-term technological edge over Beijing.

The controversy escalated after Representative John Moolenaar, a Michigan Republican who chairs the U.S. House Select Committee on the Chinese Communist Party, formally demanded an explanation from Commerce Secretary Howard Lutnick. In a letter, Moolenaar asked the administration to detail the analysis behind approving the sales, arguing that the move reverses years of policy aimed at denying China access to the world’s most powerful AI hardware.

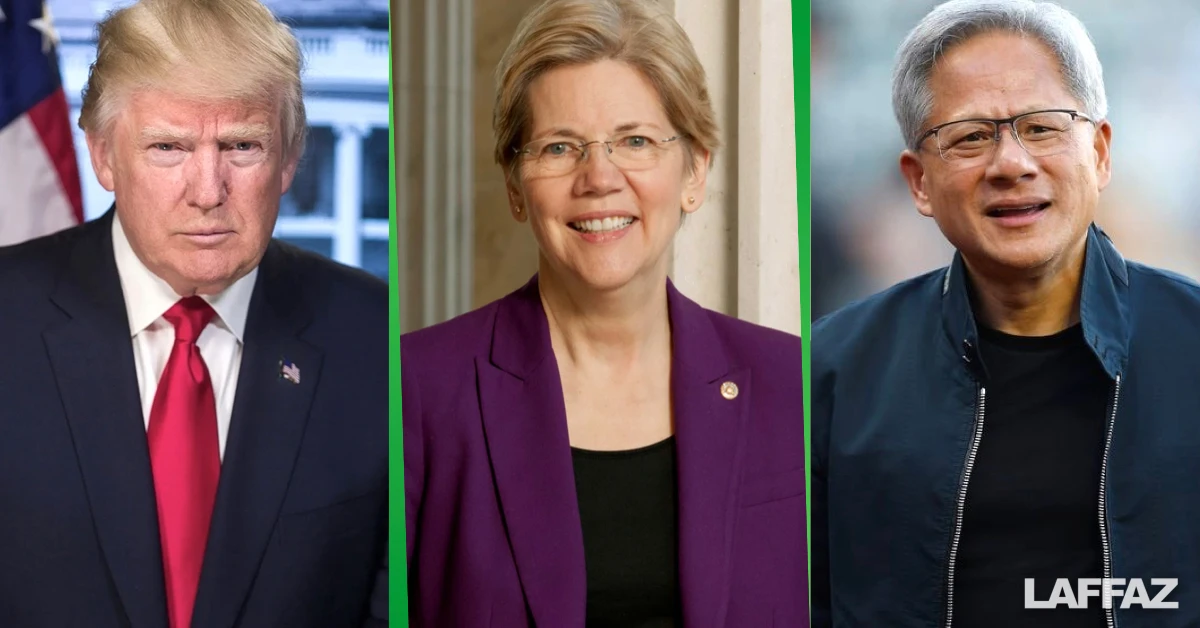

Trump announced earlier this week that Nvidia would be allowed to sell its H200 chips to “approved customers” in China, provided the U.S. government receives 25 percent of the revenue. The H200 is a predecessor to Nvidia’s latest flagship processors but remains widely used in advanced AI workloads across the U.S. industry.

For years, both Trump’s first administration and the Biden administration tightened restrictions on exports of high-end AI chips, citing concerns that such technology could accelerate China’s military capabilities and surveillance systems. The new decision marks a clear departure from that approach and has unsettled lawmakers from both parties.

In his letter to Lutnick, Moolenaar cited reports suggesting the decision was influenced by claims that Huawei Technologies had achieved major performance gains with its own AI chips. He pushed back on that rationale, writing that the gains were tied to chips illegally procured through shell companies using suppliers in Taiwan and South Korea, rather than genuine domestic breakthroughs. Huawei’s next generation of chips, he argued, is expected to fall behind once the company relies solely on Chinese manufacturing.

That expected setback, Moolenaar said, was evidence that earlier export controls were working. Reversing course now, he warned, risks eroding the strategic advantage the United States built by restricting China’s access to advanced compute.

“As AI evolves, aggregate computing power, not theoretical per-chip efficiency, will remain the engine of progress,” Moolenaar wrote. “Approving the sale of cutting-edge chips to Chinese companies risks undercutting the extraordinary strategic advantage that President Trump achieved in his first term.”

On the Senate side, Democratic Senator Elizabeth Warren delivered some of the sharpest criticism yet, declaring that Trump’s decision “sells out American national security.” Speaking on the Senate floor, Warren said the administration knows that China gaining access to previously restricted chips “poses a serious threat to our technological leadership and national security.”

Warren also renewed her call for Nvidia CEO Jensen Huang and Commerce Secretary Howard Lutnick to testify before Congress about the agreement. She pointed to a recent Justice Department announcement touting a crackdown on a “major China-linked AI tech smuggling network,” arguing that the timing underscored the risks of loosening export controls.

The backlash has not been confined to Democrats. Some Republicans who have championed aggressive measures to counter China’s technological rise have also expressed concern that the decision sends mixed signals to allies and adversaries alike.

Nvidia, however, has pushed back forcefully against the criticism. Responding to Warren’s remarks, an Nvidia spokesperson said the H200 sales to China will still require a U.S. government license and “at most will be a smaller percentage of the Hopper and Blackwell compute already sold to U.S. customers.”

“We heard the same arguments about the H20, and the administration’s critics had it backwards,” the spokesperson said, referring to the less-powerful chips the White House had previously approved for sale to China.

“Selling H20 was good for America’s economic and national security. After H20 shipments were blocked, America lost billions, and foreign AI chip firms stepped into the gap and grew dramatically,” the spokesperson added.

“America’s foreign competitors and the Administration’s critics are pushing the same end, to force massive commercial markets to support and promote foreign competition,” the spokesperson said.

The debate highlights a widening divide over how best to balance national security with economic competitiveness. Critics of tighter controls argue that overly restrictive policies could undermine U.S. chipmakers, reduce investment in domestic innovation, and push customers toward non-U.S. suppliers. Supporters counter that short-term commercial losses are worth it to preserve long-term strategic dominance in AI.

As pressure mounts, lawmakers are signaling that the issue is far from settled. Warren urged Congress to advance bipartisan legislation that would impose stricter limits on advanced chip exports, while critics of such bills warn they could hurt U.S. competitiveness.

The White House and the Commerce Department have not publicly explained the full rationale behind the H200 decision. With formal inquiries now underway and demands for congressional testimony growing louder, Trump’s move to open the door to Nvidia’s chip sales in China is set to remain a flashpoint in Washington’s broader struggle over technology, trade, and national security.