India’s Micro, Small, and Medium Enterprises (MSME) sector is a powerhouse, contributing nearly 30% of the country’s GDP and employing over 110 million people. From a neighborhood kirana store in Pune to a chain of cafés in Bengaluru, these enterprises form the backbone of India’s economy. However, as the market becomes more competitive and consumer expectations rise, MSMEs face the dual challenge of managing operations efficiently while scaling growth.

Digital transformation has offered a lifeline. With UPI payments, QR code adoption, and affordable mobile devices, Indian entrepreneurs have the tools to modernize their operations. Among these, Point-of-Sale (POS) systems have emerged as crucial growth engines. No longer mere billing machines, POS platforms now combine payments, inventory management, analytics, and customer engagement, enabling MSMEs to make data-driven decisions that directly impact revenue.

Anecdote: A small apparel shop in Jaipur integrated a cloud POS system to manage sales, track inventory, and implement a loyalty program. Within six months, they reduced stock-outs by 25% and increased repeat customer visits by 18%, illustrating how a well-chosen POS system can catalyze growth.

This guide is designed as a step-by-step resource to help Indian MSMEs choose, implement, and leverage POS systems for maximum growth.

Indian POS Market Overview

India’s POS ecosystem is growing at an unprecedented rate, fueled by digital adoption, government initiatives, and the entrepreneurial surge among small businesses.

- Market Size: The Indian POS terminals market is projected to grow from USD 33.26 billion in 2024 to USD 63.17 billion by 2029, a CAGR of 11.49%

- POS Software Market: Revenue from POS software is expected to reach USD 1,073 million by 2030, CAGR 17.1%

The surge is driven by multiple factors:

- Digital Payment Adoption: UPI and mobile wallets are now household names in India, enabling MSMEs to transact seamlessly.

- GST Compliance: POS systems simplify billing and ensure accurate tax reporting, reducing compliance overhead.

- Customer Expectations: Faster checkout, multiple payment modes, and loyalty programs are increasingly expected by consumers.

- MSME Expansion: Multi-location businesses need centralized oversight for sales, inventory, and staff management.

Drivers of POS Adoption in India

| Driver | Impact | Example |

|---|---|---|

| Digital Payments Growth | Faster, secure transactions | Kirana stores adopting UPI payments to reduce cash handling |

| UPI Adoption | Lower transaction friction | Café owners accepting QR-based payments, speeding up customer turnover |

| Regulatory Push (GST) | Simplified compliance | Retailers generate accurate GST invoices automatically |

| Consumer Expectations | Faster checkout & loyalty | Multi-brand stores offering loyalty points through POS |

| MSME Expansion | Multi-location scalability | Regional apparel chains tracking inventory across 5–10 outlets |

Emerging Trends in POS Adoption

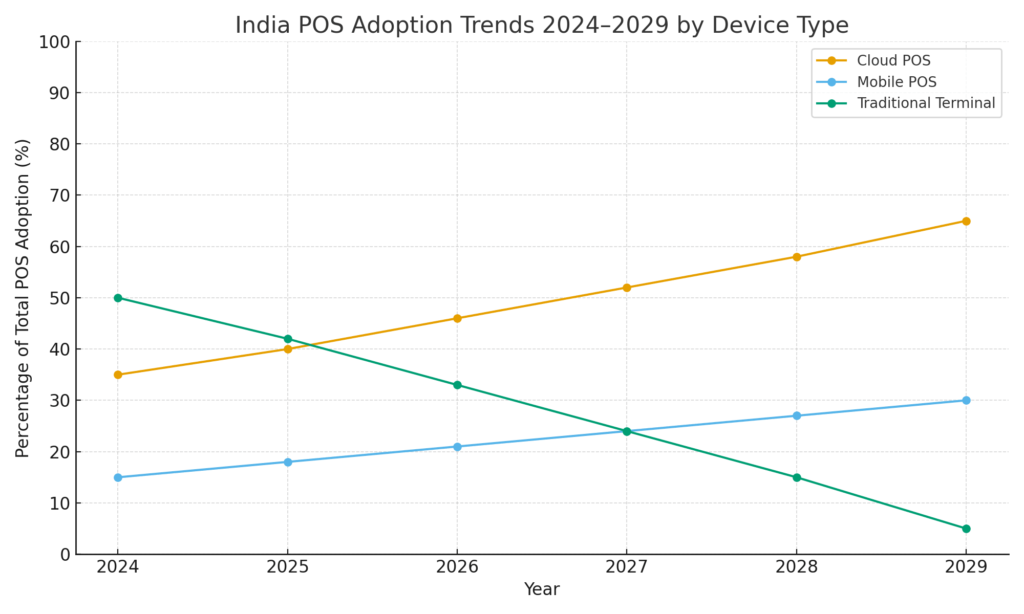

- Cloud-Based POS Solutions: Many small businesses are shifting from on-premise terminals to cloud POS for real-time data access, reduced upfront costs, and flexibility to scale.

Example: A chain of bakery outlets in Hyderabad switched to cloud POS to monitor inventory in all stores remotely, reducing wastage by 20%. - Mobile POS for Micro-Retailers: Handheld POS devices enable street vendors, kiosks, and mobile retailers to accept digital payments without a full-scale setup.

Example: A mobile electronics seller in Jaipur saw a 30% increase in daily transactions after adopting a mobile POS. - Integration with Loyalty Programs: Modern POS systems support customer engagement through points, discounts, and promotions, driving repeat purchases.

- Analytics and Reporting: Small businesses are now accessing data-driven insights such as peak hours, best-selling products, and promotional effectiveness, previously available only to large enterprises.

- AI-Powered Forecasting: Predictive analytics helps SMEs plan inventory and promotions in advance, reducing stock-outs and optimizing sales strategies.

How POS Systems Drive Business Growth in India

POS systems have evolved from simple billing machines into growth engines for modern Indian businesses. Their impact spans revenue, customer experience, efficiency, compliance, and long-term business stability.

Below is an expanded, in-depth exploration of how POS drives scalable growth in retail, restaurants, salons, pharmacies, and other MSMEs.

1. Streamlining Sales, Billing & Checkout Processes

In India’s hyper-competitive retail landscape, checkout experience directly affects customer retention. Long queues and manual billing errors remain top reasons for customer dissatisfaction, particularly in small kirana stores and mid-sized retailers.

Modern POS systems eliminate these issues by enabling:

- Faster checkout with barcode scanning

- Unified billing for retail + online orders (omnichannel)

- Automatic GST calculation

- Multiple payment modes including UPI, wallets, cards, BNPL

Example: An apparel store in Bengaluru reduced average checkout time from 6 minutes to 1.8 minutes after adopting a cloud POS – contributing to an 18% increase in repeat customers during peak season.

2. Real-Time Inventory Management Prevents Revenue Leakage

Inventory mismanagement remains one of the biggest causes of revenue loss for Indian MSMEs.

A POS system helps businesses:

- Track real-time stock levels

- Predict low-stock items

- Automate reorder reminders

- Identify non-moving inventory

- Prevent pilferage and stock manipulation

Example: A pharmacy chain in Hyderabad used POS-based stock alerts to reduce “out of stock” situations by 41%, boosting monthly revenue by 22%.

3. Customer Experience & Retention through Built-In CRM

A modern POS doubles as a customer relationship management tool:

- Saves customer purchase history

- Tracks buying patterns

- Sends automated offers & reminders

- Enables loyalty programs

Example: A salon in Gurugram achieved a 30% increase in returning customers using POS-based automated appointment reminders and loyalty credits.

4. Better Financial Visibility & Business Reporting

Without POS, MSMEs rely on manual books or spreadsheets that error-prone and hard to analyze.

POS systems generate reports such as:

- Sales by day/hour

- Top-selling products

- Staff performance

- Profit margins

- Cash flow reports

- Daily/weekly GST reports

Example: A Pune-based café chain identified that 53% of its revenue was happening before 1:00 pm. This insight led them to launch a breakfast menu, increasing weekday revenue by 27%.

5. GST Compliance and Automated Tax Reporting

India’s GST framework requires:

- Accurate invoices

- Tax breakup by CGST/SGST/IGST

- HSN codes

- Real-time reporting

A POS system automatically formats invoices according to GST rules.

Result: Businesses save hours of manual work per week and avoid penalties due to manual invoicing mistakes.

Types of POS Systems in India: Detailed Comparison

India’s POS market offers multiple systems suited for different business scales.

| POS Type | Best For | Strengths | Limitations |

|---|---|---|---|

| Cloud POS | Retail, F&B, salons, multi-location stores | Real-time sync, remote dashboard, online/offline sync | Requires stable internet |

| Mobile POS (mPOS) | Street vendors, food carts, pop-up stores, small retailers | Low-cost, UPI-first, portable | Limited inventory features |

| Traditional POS Terminal | Large retail chains | Stable hardware, integrates with scanners | Expensive, lacks cloud mobility |

| Tablet POS | Cafés, quick-service restaurants | Compact, touchscreen, easy UI | Not ideal for very high-volume retail |

| Smart POS Machines | Pharmacies, tier-2 retail | Built-in printer + payment terminal | Smaller screen, less flexible |

Cost vs. ROI: How Soon Does POS Pay for Itself?

A well-implemented POS system often pays for itself within 3–6 months due to savings and efficiency gains.

Cost Breakdown:

| Expense | Typical Cost in India |

|---|---|

| POS Software Subscription | ₹600 – ₹3,000/month |

| Mobile/Tablet POS Device | ₹10,000 – ₹28,000 |

| Smart POS Machine | ₹12,000 – ₹20,000 |

| Barcode Scanner & Printer | ₹3,000 – ₹8,000 |

| Staff Training | Included with most providers |

ROI Calculation Example:

A mid-sized grocery store using POS saw:

- 22% revenue increase due to automated reordering

- 18% reduction in pilferage

- 12 hours saved per week in manual billing & stock counting

- 28% higher repeat customer visits through loyalty offers

– Total financial impact: ~₹42,000/month

– POS subscription: ~₹2,000/month

– ROI > 20x

POS quickly becomes a profit center, not an expense.

To Sum Up

India’s retail, F&B, services, and MSME sectors are undergoing a massive digital shift, and POS systems now sit at the center of this transformation. What began as simple billing tools have evolved into full-scale business management platforms that improve speed, efficiency, and customer experience while reducing operational blind spots.

A modern POS solution helps businesses streamline checkout, manage inventory in real time, strengthen customer loyalty, and stay GST-compliant without stress. When implemented strategically, POS systems not only reduce costs and errors but also enable smarter, data-driven decisions that directly boost revenue. From kirana stores and pharmacies to cafés, salons, and multi-outlet retail chains, every business category in India stands to gain from adopting the right POS setup.

As digital payments, omnichannel retail, and mobile-first commerce continue to rise, POS adoption in India will only accelerate – shifting from traditional terminals to cloud-based and mobile POS solutions. For MSMEs looking to scale sustainably, integrating a POS system is no longer optional; it is a long-term investment in operational excellence and competitive edge. In a market as fast-evolving as India’s, businesses that embrace POS today will be the ones leading tomorrow.