SoftBank Group founder Masayoshi Son revealed an unusual moment of vulnerability on Monday, admitting he “was crying” when the company sold its entire $5.8 billion Nvidia stake last month, a move that forced one of tech’s most ambitious risk-takers to part with a prized asset to fuel even bigger artificial intelligence ambitions.

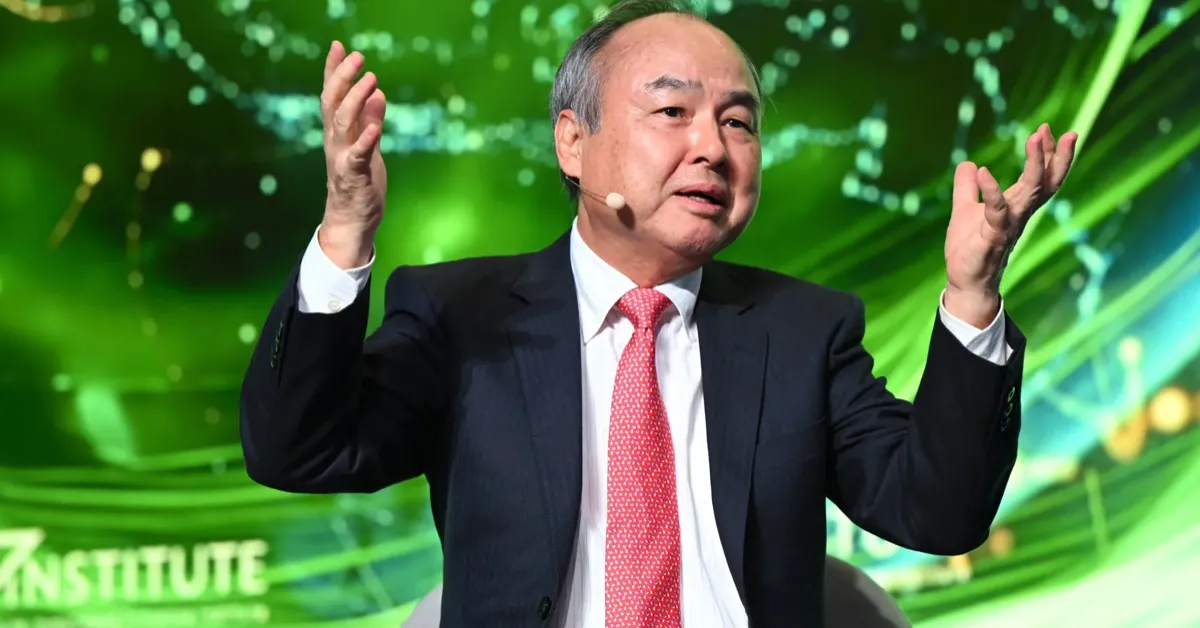

Speaking at the FII Priority Asia forum in Tokyo, Son laid bare the emotional calculus behind one of Wall Street’s most consequential investment decisions in recent months.

“I respect Jensen, I respect Nvidia so much, I don’t want to sell a single share,” Son said, referencing Nvidia CEO Jensen Huang. “I just had more need for money to invest into OpenAI, invest into our opportunities, so I was crying to sell Nvidia shares. If I had more money, of course, I wanted to keep Nvidia shares, all the time, any time.”

The confession offers rare insight into the brutal trade-offs that even the world’s deepest-pocketed technology investors now face. SoftBank’s November disclosure that it had liquidated all 32.1 million Nvidia shares sent shockwaves through financial markets, with some interpreting the move as a bearish signal from a major AI investor about chip valuations.

But Son’s tearful admission suggests a more nuanced motivation: not skepticism about Nvidia, but conviction that OpenAI and AI infrastructure represent an even more compelling opportunity in the emerging technology stack.

The Strategic Pivot: Chips Versus Software

SoftBank’s decision to exit Nvidia reflects a fundamental reordering of priorities within the Japanese conglomerate’s AI investment strategy. While Nvidia shares have surged more than 180 percent this year to reach a $3 trillion market capitalization, OpenAI’s private valuation has exploded from $29 billion to over $150 billion in less than two years.

For Son, the mathematics clearly favored the software layer over the hardware.

SoftBank committed $40 billion to OpenAI in April 2025, including a $22.5 billion payment due by the end of 2025. The firm is also participating in the “Stargate” project, a $500 billion data center infrastructure initiative alongside OpenAI and Oracle, and spent $6.5 billion acquiring chip designer Ampere Computing.

These commitments signal a portfolio shift toward controlling the full AI stack: the platforms that drive artificial intelligence adoption, the computing infrastructure that powers those platforms, and the chip design firms that complement Nvidia’s dominance in graphics processing units.

“I didn’t want to part with a single share. I simply had a greater necessity for capital to invest in OpenAI and other ventures,” Son said, describing the Nvidia divestiture as “devastating” despite its strategic necessity.

Financial Validation of the Bet

Early returns suggest Son’s pivot is working. SoftBank’s second-quarter net profit more than doubled to 2.5 trillion yen ($16.6 billion) in the fiscal period ending September, driven largely by valuation gains in its OpenAI holdings. The company’s broader AI investment portfolio has delivered substantial unrealized returns even as the Nvidia sale itself was forced to raise capital.

Yet Son faces mounting skepticism about the scale of SoftBank’s AI spending. The company’s stock has declined nearly 40 percent in U.S. trading since late October as investors grew uneasy about the capital intensity of his vision. Short-seller Jim Chanos, famous for his prescient Enron call in the early 2000s, warned of emerging risks in AI cloud computing business models that are currently loss-making enterprises.

“You’ve gotta hope that changes, because if it doesn’t, there’s going to be debt defaults on these things,” Chanos said in an interview with Yahoo Finance last week.

A Familiar Pattern of Mistiming

Son’s emotional disclosure carries additional irony given SoftBank’s complicated history with Nvidia. The conglomerate first invested in the chip maker in May 2017 with a $4 billion stake, years before the current AI boom accelerated valuations. But SoftBank divested that position in 2019 for $3.3 billion, a decision that proved catastrophically mistimed. That stake would be worth approximately $178 billion at today’s valuations.

The company began rebuilding its Nvidia position in 2020, only to liquidate it again in 2025. The pattern reflects not poor judgment but rather the difficulty of timing technology investments amid rapid market shifts.

Interestingly, Jensen Huang has referenced this history with Son directly. At a technology summit in 2024, the Nvidia CEO joked with Son about the timing of earlier Nvidia sales, saying “We can cry together” as he recounted how Son was once Nvidia’s largest shareholder before selling too early.

The $10 Trillion Vision

Son has positioned SoftBank’s capital reallocation as part of a much larger strategic vision. He believes that superintelligence – artificial general intelligence systems operating at human or superhuman levels – will eventually drive at least 10 percent of global GDP growth, requiring a cumulative investment of $10 trillion across the global technology sector.

When pressed on concerns that AI valuations have inflated into a bubble, Son pushed back sharply against critics.

“I wish to have unlimited money,” he told the Tokyo forum. “Skeptics are not smart enough. Where is the bubble?” he asked rhetorically, suggesting that the economic impact of advanced AI systems will easily justify the enormous sums currently being invested.

Sources familiar with SoftBank’s internal discussions indicate the company may consider increasing its stake in OpenAI depending on the artificial intelligence startup’s performance and valuation in future funding rounds, a prospect that suggests Son’s pivot away from Nvidia remains incomplete and responsive to market conditions.

Despite the public contrition over liquidating Nvidia shares, Son’s actions reveal calculated conviction about which layer of the AI economy will generate superior returns over the coming decade.